For any fiduciary, institutional or individual investor considering precious metals and wants to understand the real structural risks between owning physical metals held directly vs ETFs in a brokerage account, this research is for you.

As manager of a physical gold and silver fund and the owner of a large Depository, I understand the nuances between price representation vs actual ownership of precious metals.

Although, investors use ETFs for price exposure, they will be shocked to understand that is all they own…the price for that moment.

First lets go back to the Gamestop/Robinhood fiasco. That event uncovered a bonafide true systemic risk of the system. See the following video to understand what a real liquidity crisis means for anyone with a brokerage account as well as the domino effect to other brokerages, banks and clearing members.

Another systemic risk is building infront of us; except this is to the potential downside. Unlike Robinhood not allowing new buying in shares what if institutions say no more selling and halt trading to protect the system?

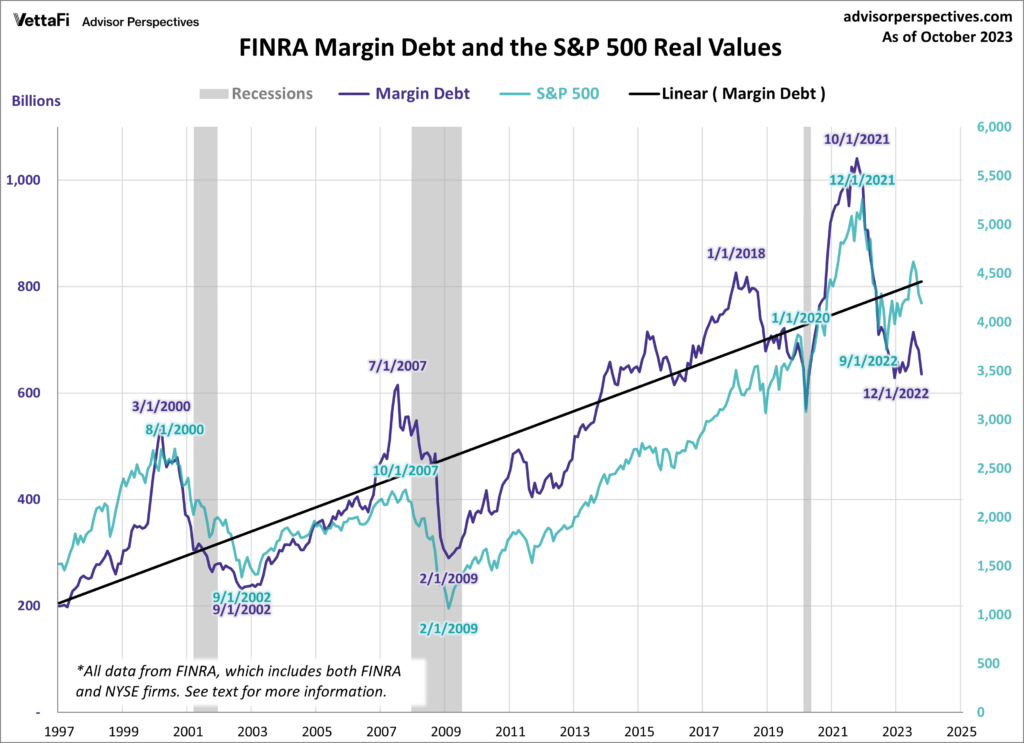

The latest margin data released by Finra through January 2020 shows margin debt levels up 2.6% month-over-month to a record high. From Advisor Perspectives website:

Trying to diversify from a systemic risk event with a traditional brokerage account is very difficult. Failures in liquidity and counterparties create a multitude of cascading events. Although extreme, just ask the dinosaurs (who had great diversity until the asteroid hit).

What many do not understand are the inner workings of the financial system and what that means to the average brokerage account holder.

What we thought we saw on our brokerage account representing true ownership was merely a mirage. The registered owner for all shares held in a brokerage account (street name) belong to Depository Trust Company (DTC).

To confuse matters more, Cede & Co. (a partnership within DTC) is listed as the registered owner and not you. Welcome to America!

The ultimate investor is just considered a beneficial owner. Source from investor.gov

And to understand the difference between registered and beneficial owners, look no further. Source.

To explain this more clearly, lets look at a ETFS Silver Trust filing with the SEC. “The Securities will be issued as fully-registered securities registered in the name of Cede & Co.”

“all Securities deposited by Direct Participants with DTC are registered in the name of DTC’s partnership nominee, Cede & Co.”… “DTC has no knowledge of the actual Beneficial Owners of the Securities”

GLD prospectus pg 30, “Individual certificates will not be issued for the Shares. Instead, global certificates are deposited by the Trustee with DTC and registered in the name of Cede & Co., as nominee for DTC.

The global certificates evidence all of the Shares outstanding at any time.”

Full PDF

Due to structural/operational risks and potential inability to take delivery of precious metals within ETFs described in more detail here, what is the purpose of a precious metal ETF?

1/21 I have been asked by many people if there are any LBMA vault custodian or subcustodian concerns. Upon investigation this is what I found. Auditing responsibilities of LBMA vaults in London may surprise you.

— bob coleman (@profitsplusid) March 4, 2021

Well just ask a boat owner… “The two happiest days in a boat owner’s life: the day you buy the boat, and the day you sell the boat.” However, if the boats sinks between between these dates that becomes your liability.

The ETFs are trading vehicles. In the case of precious metals, they represent nothing more than price volatility.

Many of these ETFs are structured as indenture trust or grantor trusts. These trusts are not an investment company registered under the investment company act of 1940.

Physical metals held directly either within arm’s reach or in a segregated and insured vault without any intermediary, is the best way to reduce risk. I explain this further with this interview.

Fiduciaries & investors must understand the benefits of physical metal as well as the simplicity of having direct control of your assets during systemic risk.

If the financial system takes on water, physical metal held directly has no counterparty and nowhere is Cede & Co. stamped on the bar.

If this does not provide clarity and you still have questions, please reach out or provide feedback. I also ask that this article be passed onto others so they understand the important distinction between 2 entirely different investment structures.