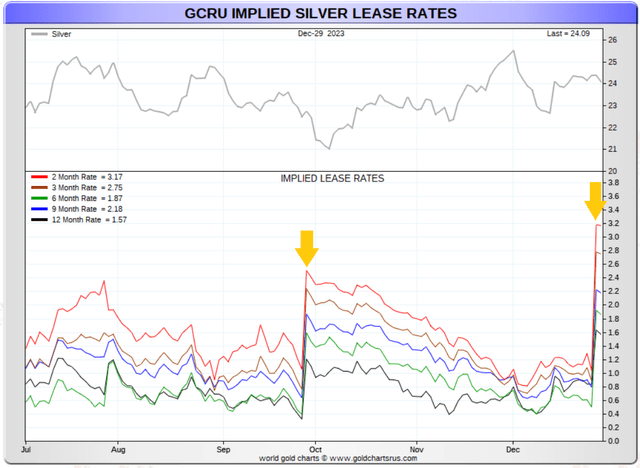

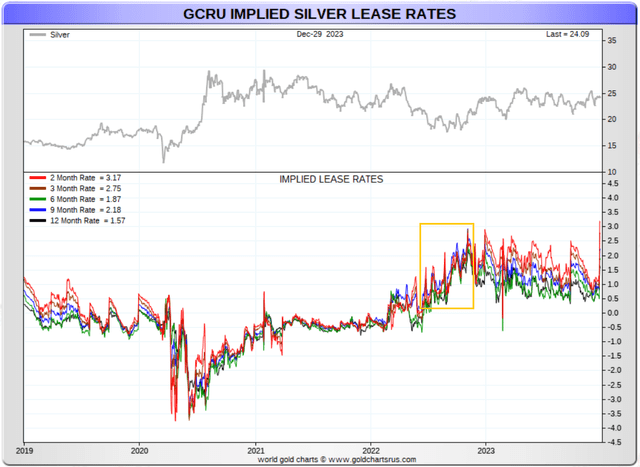

Several people asked me to comment on why silver lease rates are so high and what that means for silver going forward. We recently saw a spike in lease rates as viewed in the charts below.

The lease rates were also discussed in the following article by Paul Franke. https://seekingalpha.com/article/4661025-silver-is-now-a-strong-buy-highest-lease-rates-since-2008?utm_campaign=twitter_automated&utm_content=article&utm_medium=social&utm_source=twitter_automated

What and why this is happening will stun many. We will start with the state of the retail/wholesale coin and bar industry. The industry is swimming in inventory. Premiums on products have collapsed. More importantly, bids from dealers willing to buy back the product have also collapsed. This is a sign that the balance sheets of many dealers in the industry are stretched or near maxed out. This has been due to a large amount of selling coins and bars by the public over the last 4 months.

At this point you may be wondering, why are lease rates going up if the industry is flooded with retail products? Lease rates are based on the activities of larger users, producers, fabricators, refiners, and bullion banks.

At the beginning of the 4th quarter of 2023, many mining companies started to close out hedges. These are futures contracts or sell transactions against existing inventory or ongoing mining production. Basically, creating a price neutral strategy. Since silver was trading near the cost of production for these mining companies, they basically were locking in very little profit without the ability to capture any upside. In addition, maintaining hedges requires adding capital to their trading account to maintain margins. This is due to the short sale going against them when the price is rising. Without their production being processed at the refiner, there was a cash crunch developing.

Then in November the price of metals took off. Much of the price increase was attributed to the unwinding of these short sales. Meaning, the mining companies had to buy back at a loss to clear the hedge or short sale from their books. This moved the price of silver toward $26 an ounce. After closing their hedges, some mining companies publicly announced that they were closing their hedging program and going naked long with their production. This meant they were going to capture the upside in the price of silver. However, what occurred next was just the opposite of what mining companies were expecting. The silver price broke right back down to $23. An area where many are breaking even with their production.

These mining companies have decided to hold back production or cancel and extend their forward contract sales that are near settlement. What does this mean? Less production or supply coming to market. Especially at a time when larger participants need this supply for fabrication or industrial use. Basically, metal at the exchanges have not been rising as one would expect when refiners see a lack of demand from physical retail and institutional investors. Instead, these larger industrial players are creating a tighter environment for larger 1000 oz bars or other industrial forms of silver that is directly related to this decline in supply.

The way I see the outcome of this oddly strange environment is that either 1) mining companies balance sheets will be negatively impacted if their strategy goes against them and silver price stagnates or declines or 2) the price starts to rise for reasons the retail investor does not understand and they continue to sell into the rally expecting a sell off to resume. In the second option, this could become very disruptive for the dealers in the retail/wholesale coin and bar industry. I have been warning for over a year that premiums had most likely peaked, and the fat profits the dealer industry saw was most likely behind them. Maybe the sale of Apmex (one of the largest retail precious metals dealer) could have marked the top for industry profit margins.

The retail investor has also become frustrated by the lack of action or price movement higher. Thiis maybe one reason why we are seeing liquidation in this space.

With all this said, I am going to lay out a forecast that will blow many away. As we saw in 2021, the retail industry cannot make the price of silver break out to all-time highs. Due to the nature of transactions surrounding silver via collateralization, financialization, leasing, loans, hedging, margin, leverage, swaps and other trading and industry practices, silver needs disruption in true supply to pressure these activities and force transactions to unwind that were structured to protect against volatility. This is a head scratcher that many investors may not fully understand or appreciate.

When lease rates are rising like they are, many look for backwardation in the futures markets to explain the tightness. Normally demand is the driver that says we do not trust the future and want the metal now. But with interest rates much higher than in 2021-2022, the forward curve is in contango due to higher carrying costs (interest, storage, etc). What we are seeing instead of backwardation is a rise in leasing rates. Also, we are seeing a floor in price that normally higher interest rates would tend to weigh on metals. The supply issues creeping into the market are setting up a phenomenon that could propel the price higher in silver at a time when many are least expecting it. Look at the sentiment measured by physical investor activity, ETF outflows, and declining trading volumes on the Comex.

A supply shock will be difficult for retail investors to understand when the physical investors are seeing dealers struggling to buy back much more product or offering much lower premiums just to stay in business. Unless, silver breaks out through $28-$30 and finally brings momentum investors to the table, a rise in price to the top of the trading range could be viewed as a selling opportunity by investors to hopefully engage on the next sell off or just exhausted from holding through the years.

The least likely outcome that could unfold would be a structural decline in larger bar supply over a short window where the price spikes higher regardless of retail activity. This would be most likely caused by an unwinding of various contracts as mentioned above. For many on the sidelines, they will most likely not participate because they will not understand nor trust the move.

Let’s see how this unfolds.