Disclaimer: The following is an educated opinion based on market observations and analysis.

One tool is through ETFs (Exchange Traded Funds) Warning this short article is about the structure surrounding these products. The end of this article may shock most of you.

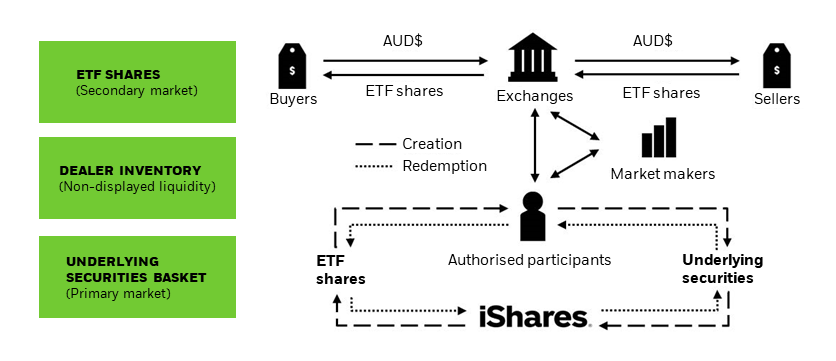

Market makers and authorized participants (APs) interact with ETFs to help the ETF’s share price align with the value of its underlying instruments. APs can create and redeem shares based on the flow of the market as well as profit from arbitrage pricing opportunities between the NAV and underlying instrument.

Market Makers have the ability to go short or naked short to provide a market to buyers. The intent is to create an orderly market when volume surges or becomes one-sided. Basically, when buying overwhelms the market and price rises due to lack of sellers, a market maker may sell shares they do not own to meet excess demand. As a market maker, the activities are not designed to take a secular position for price direction but rather a temporary position. However, unexpected events can create unexpected outcomes.

ETFs differ from stocks like GameStop (famous short squeeze). ETF shares can be created by the APs by delivering the underlying silver to the ETF and in return APs are given shares to sell to investors. In addition, shares can be created to reduce the market maker’s net short book.

So what does all this have to do with the silver price?

The ETFs can become a financial sponge to absorb investor interest in silver. How? By the ability of market makers or APs to meet buying demand by shorting shares rather than by delivering fresh silver to create new shares to deliver to investors. By creating shares and delivering silver to the ETF, this could increase support for the underlying physical silver which could additionally pressure its price, spreads, or other matrices with other collateralized players within the system. In essence, a sudden unexpected rise or continued interest in an asset could have traditional market players caught offsides. The market maker system can be an attempt to meet demand by not adding further pressure to the underlying asset but rather soaking up the flurry of demand by shorting shares that may or may not be borrowed to absorb these capital flows.

The following chart tells an interesting story about the market events surrounding the largest Silver ETF (#SLV)

As the price has taken off, there has been a net redemption of shares during this same time frame (purple circles). In addition, the short sale volume has gone through the roof. Is this a case where investors have been net sellers the whole way up in price and have simply wanted to divest themselves of this asset while it was breaking through a massive resistance level on the charts?

Could a group of investors be fighting the trend and shorting SLV on every tick higher?

Or lastly, could market makers or APs been shorting shares to meet this demand because delivering fresh silver may have put upward pressure on the underlying silver price which would have signaled stronger market interest than what was being portrayed?

We are all being led to believe China has been the mystery buyer in precious metals and that was the reason for the price surge. However, if that was the case and physical metals were that tight why didn’t the EFP (Exchange for Physical) spread collapse or go toward backwardation faster during the last month? Instead, the EFP stayed strong, evidence of more buying in the futures and paper markets.

Here is a possible mind blower I may have learned:

What if another entity(s)/government was front running the massive Chinese Bank/Retail demand and forcing them to pay even higher prices for physical gold and silver? The reason for the lack of physical deliveries to major gold and silver ETFs in the USA could be the reason why capital flows through US Exchanges were met by more short sales and less actual physical share creation. The physical metal was being marked up and sold/delivered to China at increasingly inflated prices. The reason for this, one asks? Simple, forcing the Chinese to pay higher prices for precious metals reduces liquidity for other areas of their economy, thus reducing demand for commodities like copper that may increase inflation here in the USA. Remember this is an election year and its everyone or every country for themselves.