Let’s dissect the recent story about the effect on gold with Basel 3 and ask the real question, How do banks remove the 85% required stable funding ratio for gold? Keep in mind, Basel III is an international voluntary regulatory framework designed to strengthen bank capital.

Britain carves out exemption for gold clearing banks from Basel III rule (Read full article)

There are 4 important quotes in the story and the rabbit holes are endless.

1. “Following a consultation, the Bank of England’s Prudential Regulatory Authority (PRA) said on Friday it had “decided to amend its approach to precious metal holdings related to deposit-taking and clearing activities.”

Important to separate clearing from deposit taking activities.

Prudential Regulation Authority “PRA” (regulates UK Banks)

Full PS17 Policy Statement PDF Here

“The PRA has considered the responses and decided to amend its approach to derivative client clearing. The PRA will exempt from the NSFR derivative client clearing activities with qualifying CCPs (QCCPs qualifying central counterparty), provided that the institution does not provide to its clients guarantees of the performance of the QCCP and, as a result, does not incur any funding risk.”

This is important and explains part of the migration in precious metals and certain precious metals activities in 2020 to Central Counterparties (CCP) recognized by the Bank of England. The Chicago Mercantile Exchange, Inc. (CME) which owns the COMEX is one such party. The CME also operates CME Clearing House where it oversees all aspects of the physical delivery process of unallocated accounts for gold and silver. The delivery of bullion occurs through “LOCO London” unallocated accounts operated by LPMCL member banks.

Clearing of London Gold Forwards Full Article

Banks were motivated to reduce certain unallocated trading practices and corresponding liabilities by simply transferring the trading risk to regulated exchanges and off their balance sheet. Although, they lost proprietary revenues, the cost of reserve funding was removed. In this instance, the customer opens an account and trades through the bank and not with the bank. The only reserves banks need to hold against the customer account is the amount above the minimum margin requirement to maintain the investment.

Will discuss deposit taking activities below.

2. “It said it had introduced an “interdependent precious metals permission” which would reduce the size of the required capital buffer.”

“The PRA has considered the responses and decided to amend its approach to precious metal holdings related to deposit-taking and clearing activities. The PRA has introduced an interdependent precious metals permission for which firms may apply in respect of their own unencumbered physical precious metal stock and customer precious metal deposit accounts. When the permission is granted, firms would apply a 0% RSF (required stable funding) factor to their unencumbered physical stock of precious metals, to the extent that it balances against customer deposits. The PRA has decided not to amend its approach for other aspects of the treatment of commodity-related activities. The PRA considers its overall approach to commodities in the NSFR to be generally appropriate. The PRA notes that it is able to waive or modify rules under section 138A of FSMA where a firm can demonstrate to the PRA’s satisfaction that the application of the unmodified rule would impose an undue burden on a firm, or would fail to achieve its intended purpose, and where modifying it would not adversely affect the advancement of the PRA’s objectives.”

This section is ambiguous as it may pertain to allocated or unallocated positions. However, in an allocated setting in London, gold is specifically held and owned by the customer and is not on the balance sheet of the bank. Essentially, the account operator (bank) is acting simply as custodian. This leads us to unallocated positions.

Thankfully, there is clarity when defining interdependent asset and liability (IA&L) https://lexparency.org/eu/CRR/ART_428f/ (unfortunately the lexparency website is offline, but here is the full text of the page in question:)

Article 428f — Interdependent assets and liabilities

Subject to prior approval of the competent authorities, an institution may treat an asset and a liability as interdependent, provided that all the following conditions are met:

the institution acts solely as a pass-through unit to channel the funding from the liability into the corresponding interdependent asset;¶

the individual interdependent assets and liabilities are clearly identifiable and have the same principal amount;

the asset and interdependent liability have substantially matched maturities, with a maximum delay of 20 days between the maturity of the asset and the maturity of the liability;

the interdependent liability has been requested pursuant to a legal, regulatory or contractual commitment and is not used to fund other assets;

the principal payment flows from the asset are not used for other purposes than repaying the interdependent liability;

the counterparties for each pair of interdependent assets and liabilities are not the same.

Assets and liabilities shall be considered to meet the conditions set out in paragraph 1 and be considered as interdependent where they are directly linked to the following products or services:

centralised regulated savings, provided that institutions are legally required to transfer regulated deposits to a centralised fund which is set up and controlled by the central government of a Member State and which provides loans to promote public interest objectives, and provided that the transfer of deposits to the centralised fund occurs on at least a monthly basis;

promotional loans and credit and liquidity facilities that fulfil the criteria set out in the delegated act referred to in Article 460(1) for institutions acting as simple intermediaries that do not incur any funding risk;

covered bonds that meet all the following conditions:

they are bonds referred to in Article 52(4) of Directive 2009/65/EC or they meet the eligibility requirements for the treatment set out in Article 129(4) or (5) of this Regulation;

the underlying loans are fully match funded with the covered bonds that were issued or the covered bonds have non-discretionary extendable maturity triggers of one year or more until the term of the underlying loans in the event of refinancing failure at the maturity date of the covered bond;

derivative client clearing activities, provided that the institution does not provide to its clients guarantees of the performance of the CCP and, as a result, does not incur any funding risk.

EBA shall monitor assets and liabilities, as well as products and services that are treated as interdependent assets and liabilities under paragraphs 1 and 2, to determine whether and to what extent the suitability criteria laid down in paragraph 1 are met. EBA shall report to the Commission on the results of that monitoring and shall advise the Commission on whether an amendment to the conditions set out in paragraph 1 or an amendment to the list of products and services in paragraph 2 would be necessary.

_end quoted section_

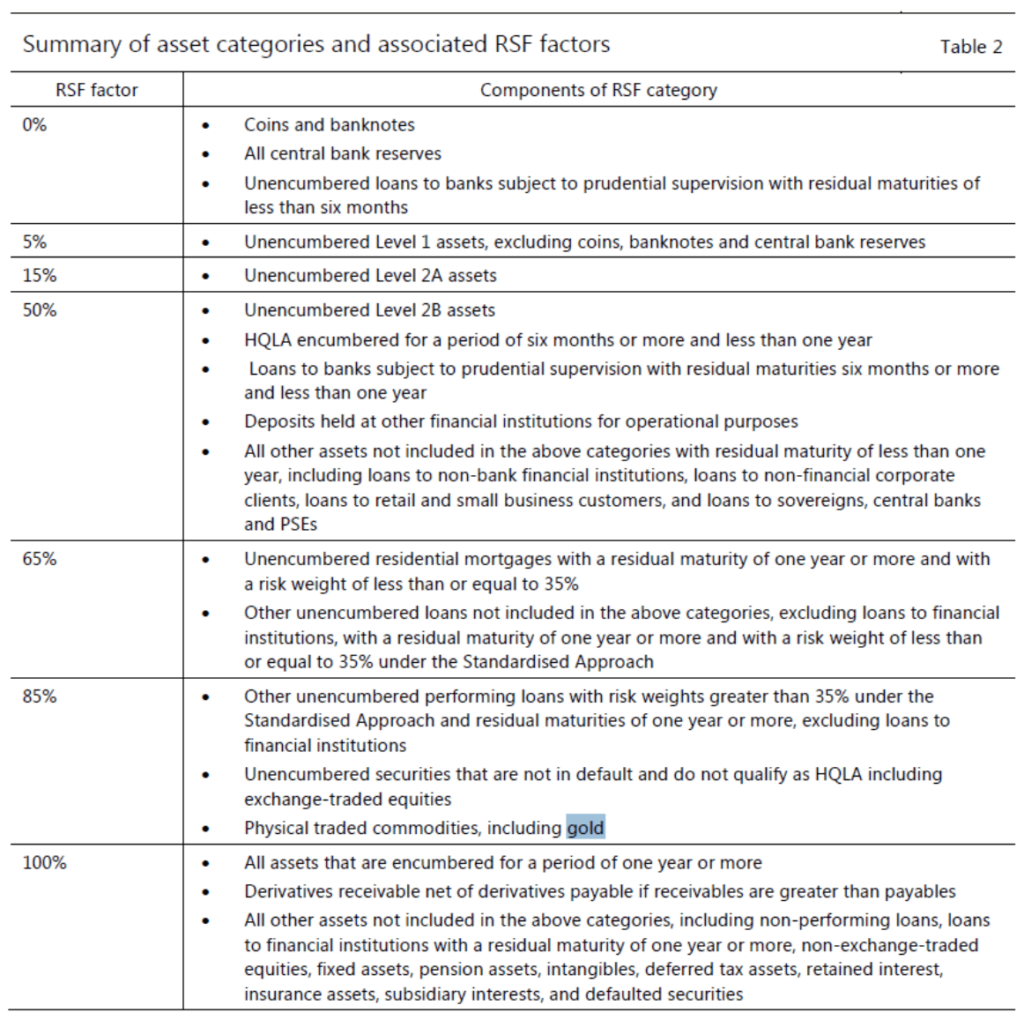

What is important here is that the bank’s cost of capital or funding is greatly reduced from 85% to 0% when they have unencumbered physical precious metal stock matching the corresponding liability of their customer. Because Basel 3 does not recognize gold as a High Quality Liquid Asset (HQLA) and requires an 85% required stable funding ratio, this enormous reduction in required funding incentivizes the bank to hold physical gold.

A final version of this report was published in October 2014. https://www.bis.org/bcbs/publ/d295.htm

As part of its requests, the LBMA was lobbying for this RSF reduction to zero arguing that the IA&L acted like cash because the asset and liability line items netted each other out. Under such conditions, a covered bank would face no funding risk or benefit arising from the interdependent asset and liability. It is important to note that the PRA can waive or modify the rules. The question will be if the game of leverage and spreads simply pops up elsewhere.

3. “This is one of the key points that what we’ve been asking for all these years,” said Sakhila Mirza, the LBMA’s chief counsel. “Clearing will be exempt.”

13.52

“The PRA has considered the responses and decided to amend its approach to derivative client clearing. The PRA will exempt from the NSFR derivative client clearing activities with Qualifying Central Counterparty (QCCP), provided that the institution does not provide to its clients guarantees of the performance of the QCCP and, as a result, does not incur any funding risk.”

This is important to breakdown. The movement within Basel 3 was to transfer the risk away from banks’ balance sheets. Shifting clearing onto organized exchanges (Comex) removed counterparty liability, in turn removed funding requirements. These Qualifying Central Counterparties would be responsible for overseeing/settling buyers’ and sellers’ transactions.

4. “The PRA said it would not classify gold as a high-quality liquid asset (HQLA), which would have freed other trades such as precious metals loans and leases from the high capital requirement.”

PRA’s treatment of gold as a HQLA is consistent with the Basel Committee. As Kamola Bayram and Adam Abdullah pointed out in their research, to be considered HQLA, measurements include fundamental characteristics; low risk, ease and certainty in valuation, low correlation with risky assets, and being listed on developed and recognized exchange: market-related characteristics; active and sizable market, low volatility, and flight to the quality.

Gold failed only on the volatility basis only. One of the studies used to measure this volatility was Jonathan Batten and Brian Lucey’s Research by modeling the volatility of gold through futures market. The research was able to capture and measure high frequency data between 1999-2005. However, using a leveraged futures market to measure a physical asset without counterparty risk, is like measuring the movement of a feather in a wind tunnel. Many of the trades were not for the actual long-term resiliency of gold as much as it was for the opportunity to profit from leveraged price action or hedging. This is the frustration many physical investors have with the paper markets. Dirk Baur and Brian Lucey’s Research, who studied the volatility of gold, demonstrated that there is an inverted asymmetric reaction to positive and negative shocks, such as positive shocks increase the volatility by more than negative shocks. The authors suggested that this effect is due to the safe haven property of gold, since investors interpret positive gold price changes as an indicator of future adverse conditions and uncertainty in other markets. According to his results, inverted volatility feature of gold can lower the aggregate risk of a portfolio for specific correlation levels. The irony is that Basel 3 ignores this important property as the Basel Committee only focused on overall volatility. Isn’t the idea of a strong balance sheet during times of crisis, having assets that perform during that crisis?

Oddly, the PRA recognizes gold as a reserve asset on Central Bank balance sheets yet does not consider it strong enough the be a HQLA. One other note about the #4 comment above. The comment from PRA maybe misleading because precious metal loans and leases have nothing to do with gold as a standalone asset. In my opinion, these separate services or products can now be done through the derivatives market with Central Counterparties which eliminate high capital requirements for banks.

As mentioned above, the banks are getting around the high funding requirements through other means while giving up exclusive revenue.

The bottom line is that Basel 3 is voluntary and can be adjusted by each regulating body in each country. Gold is normally provided an 85% RSF ratio. Although unallocated gold accounts continue to exist, banks are incentivized to match their liabilities (customer deposits) with their assets (unencumbered gold). In return, the banks in London, get to claim a 0% Required Stable Funding ratio for the gold accounts on their books. Banks win with a sharp reduction in funding costs and the physical gold market benefits from a continued deleveraging of the unallocated markets. This places the spotlight directly on derivatives exchanges and its trading volume. If open interest continues to decline while physical activity can stay consistently strong, influence will shift in favor of the physical market. Let us hope this is not a case of, “the more things change the more they stay the same. “