Why Are Gold and Silver ETFs Losing Assets While Prices Climb?

I keep getting the same question:

Why are gold and silver ETFs seeing massive outflows while the prices of the metals are rising?

Let’s unpack that—because the answer reveals a lot about what’s really driving this market.

The Divergence: Prices Up, ETF Holdings Down

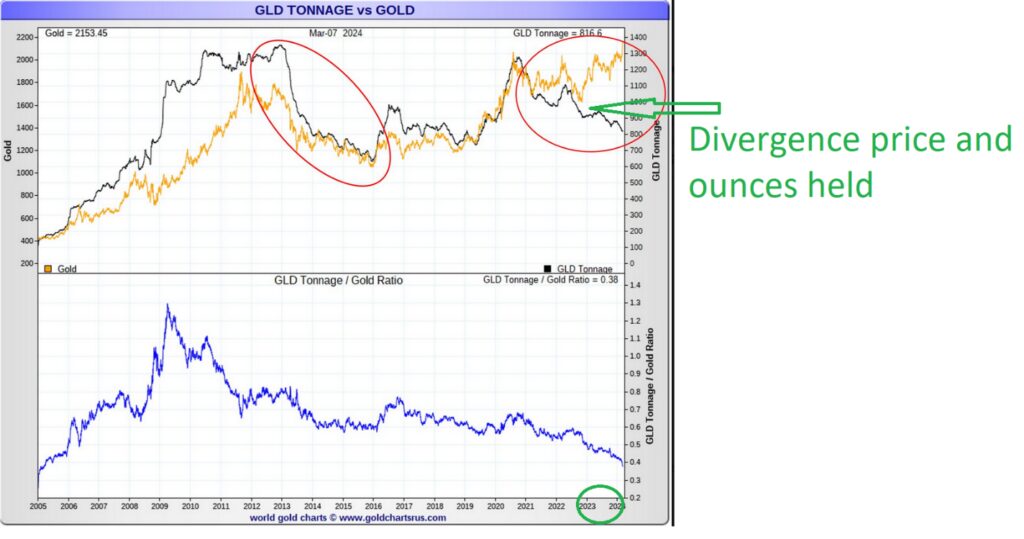

We’ve seen a steady decline in ETF shares outstanding since 2021, which directly correlates to fewer ounces held in trust. But the real divergence—falling ETF holdings while metal prices rise—started in late 2022. So… what changed?

Central Banks, Asia, and the Draining of London Vaults

Central banks have been major net buyers of gold, alongside countries like India and China, who’ve been importing both gold and silver at scale. That helps explain some of the demand—and why metal has been flowing out of London, where many ETFs store their metals.

But it doesn’t fully explain the divergence we’re seeing.

Understand What ETFs Actually Are

You need to understand how ETFs function. They’re not physical metal ownership. They’re a financial product.

*Read my article on ETF structure and custodial risk*

Also, Basel III regulations kicked in around July 2022, prompting banks to deleverage their balance sheets—especially around their involvement in precious metals.

*I break it down in detail here*

I also explained Basel III’s potential impact in this 2022 interview with Palisades Gold Radio.

If You Want to Understand Commodity ETFs, Start Here

Listen to the first 30 minutes of this broadcast for a deep dive into how these products actually work—and who really benefits.

Wall Street’s Game: Structured Products, Not Real Metal

I’ve done many presentations about how Wall Street turns commodities into structured products—with very little connection to the underlying physical market. It’s a business model built on:

- Spreads

- Leverage

- Leasing

- Arbitrage

- Loans

- Product issuance

- Derivatives

This creates a strange effect: massive volumes of paper contracts dilute the impact of the physical market on price.

Frustrated investors often chalk this up to “manipulation”—but that’s a lazy explanation. It’s a complex system, not a cartoon villain.

2020: The Derivatives Explosion

When investor interest in metals surged in 2020, Wall Street responded the way it always does: by creating supply—on paper.

That year, the OCC’s Bank Derivatives Report started showing a spike in precious metals exposure. Many of these structured products used ETFs like GLD and SLV as benchmarks. That means large banks were:

- Using their own inventory to create ETF shares

- Using those shares as the basis for derivatives sold to institutions and accredited investors

Think The Big Short: remember when Burry asked the banks to create a product to bet against housing? This is the same thing—except it’s gold.

The Charts Don’t Lie

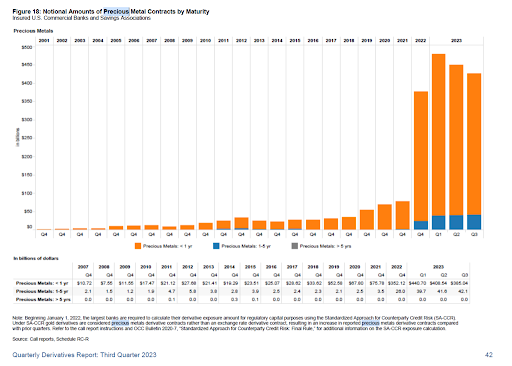

Notional Derivatives Exposure Among Banks (2023)

Gold was added to the precious metals category in 2023, which complicates back-testing. But from Q2 to Q3 of 2023, notional value dropped by $50 billion. That’s no small shift.

Example: GLD Divergence – Price vs. Ounces Held (2023)

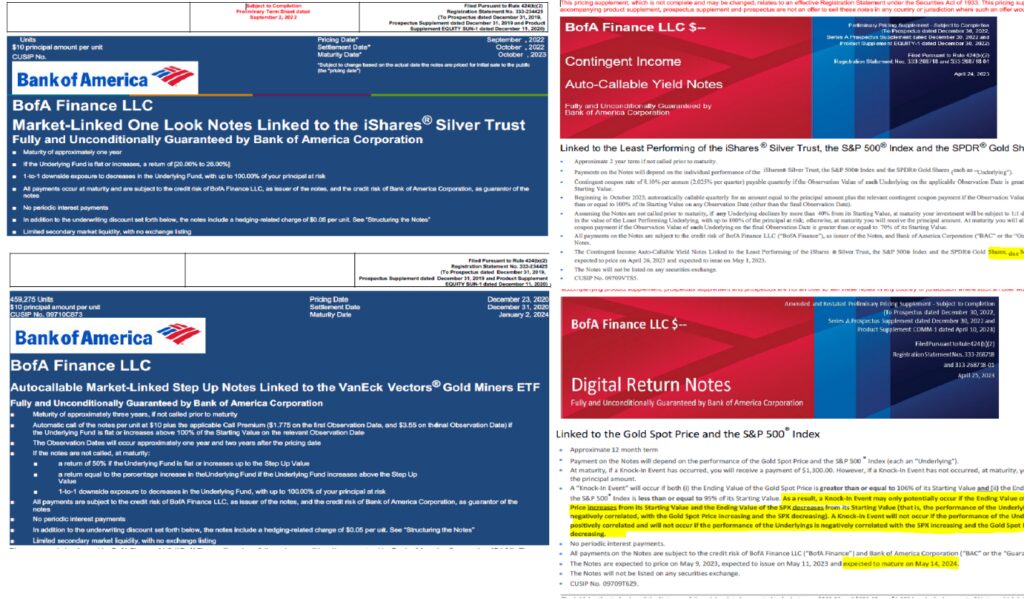

Structured Products That Don’t Touch Real Metal

So, what are these products? Just take a look.

Example: Bank-Issued Structured Products Tied to Precious Metals

These products allow institutions to “participate” in gold/silver price movement—without touching an ounce of real metal. When they mature, the need for backing inventory (i.e., metal held in ETF custody) goes away.

In 2023 and 2024, many of these matured—and banks stopped rolling them over. That aligns with the ETF asset drain we’ve been tracking.

Conclusion: Physical vs. Paper

When you connect the dots—Basel III, ETF mechanics, bank derivatives, structured products—it becomes clear:

- Wall Street’s not in the business of gold

- They’re in the business of financial engineering around gold

That’s why ETFs are bleeding ounces, even as demand for real metal rises. And it’s why the physical market is starting to flex real price influence—especially outside the West.

Final Word: Own It or Be It

If you’re an institution or high-net-worth individual who wants actual, legal ownership of physical metals, reach out.

Because if you’re investing in ETFs, derivatives, or synthetic products that only represent gold and silver prices…you might be the product, not the investor.

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]