Silver Over $60: What This Short-Covering Rally Really Signals | Bob Coleman

Silver just detonated past $60—but this isn’t about headlines or hype. It’s about a system cracking under real stress, where delivery risk, leasing failure, and sovereign accumulation are rewriting the rules.

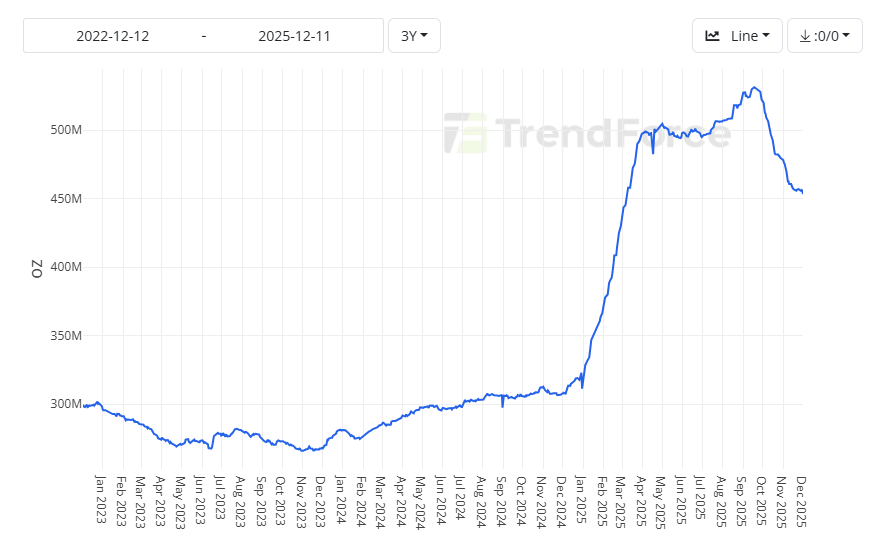

When Tom asked me to come on Financial Sense again and talk about silver’s breakout, I didn’t hesitate. What we’re seeing right now isn’t your typical price pop. Silver just punched through $60 on the back of a major short-covering rally. And while some are calling it a squeeze, this move runs deeper. Lease rates have spiked, inventories are vanishing, and confidence in the delivery system—from COMEX to London—is starting to buckle. This isn’t just hot money chasing momentum. It’s supply dislocations, structural stress, and quiet accumulation by players who don’t chase headlines.

In this briefing, I walk through why I don’t think this is the top—but the start of a much larger repricing. The industrial pipeline is tight. ETF mechanics are fragmenting. And the vault math doesn’t match the open interest. Meanwhile, most of the commentary is still quoting old narratives that ignore how fast silver’s role is changing. It’s not just industrial—it’s becoming strategic. If your ounces are held in pooled accounts or ETF wrappers, you’re exposed. This next leg of the market won’t be about price—it’ll be about access.

The Brief:

- Price Surge: Silver broke above $60/oz in a violent short-covering rally as lease rates spiked and shorts scrambled to cover.

- COMEX Stress: Registered silver is disappearing, and most eligible inventory is already spoken for—raising serious questions about delivery capacity.

- Leasing Breakdown: Exploding lease rates reflect growing lender hesitation and tightening availability of physical metal.

- Global Realignment: China is cutting back silver exports just as the U.S. designates silver a critical mineral—reshaping global supply chains.

- ETF Dislocations: SLV and other silver ETFs are diverging from NAV, signaling fractures in arbitrage and physical convertibility.

- Demand Pressure: Industrial demand is rising fast—driven by AI, solar, EVs, and energy tech—while mine supply remains flat.

- Flight to Physical: Both retail and sovereign players are now chasing allocated, segregated metal as trust in paper silver deteriorates.

- Tactical Warning: Get your silver out of the system—because the next phase of this market will be defined by access, not price.

Charts Discussed

Source: Econovis

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]