Silver’s New Playbook: Critical Metal Status, Global Hoarding, and a Market Running Out of Slack

Silver didn’t break above 50 dollars by accident. Governments, refiners, ETFs, and entire nations are clawing after the same shrinking pool of metal, while most investors still think this is “just another rally.”

Silver isn’t trading like a simple industrial metal anymore. It’s starting to behave like a strategic asset—caught between geopolitical risk, structural deficits, and a system desperate for hard collateral. That’s why I sat down with David Morgan, Steve St. Angelo, Vince Lanci, and Tom Bodrovics at The Silver Roundtable to align our views on what’s driving the shift.

The big story now is silver’s sudden push into “critical mineral” status. The U.S. has joined China and Australia in elevating silver to priority. That designation isn’t just symbolic—it greenlights subsidies, tariffs, and stockpile rebuilds without public explanation. Here’s the irony: the U.S. imports 330 million ounces a year and has almost no refining capacity. China smelts 40% of global supply and exports 136 to 145 million ounces annually. If they cut just 15–20% of that flow—and signs suggest they might—the market tightens instantly. That’s why this reclassification matters: it signals governments are preparing to compete for physical metal, not paper claims.

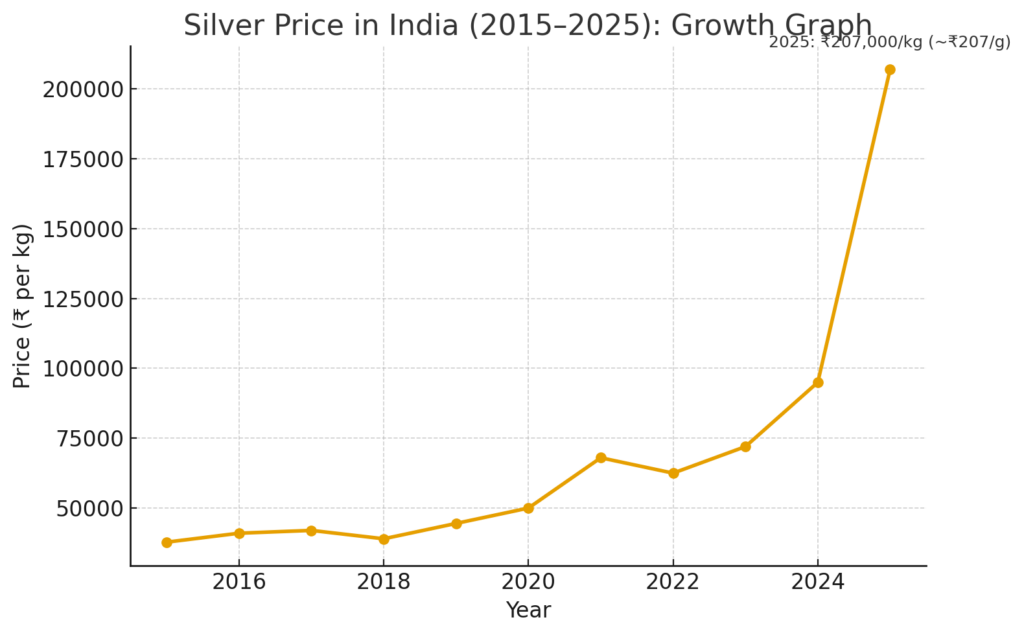

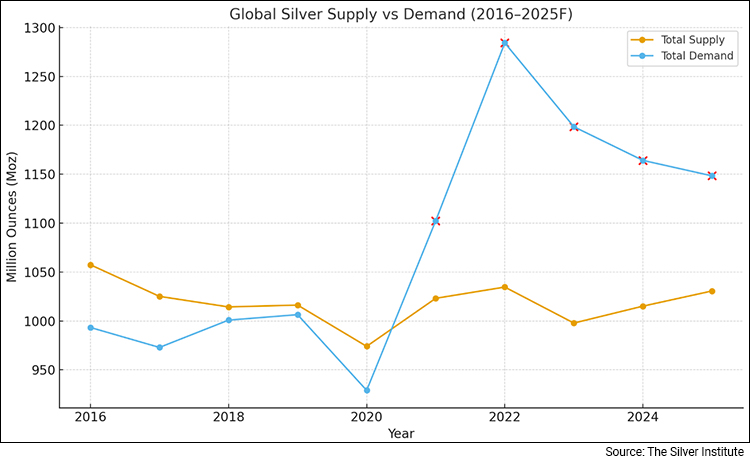

Meanwhile, the physical market is tightening in slow motion. Mine output peaked near 900 million ounces in 2015 and remains 70 million lower today. Industrial demand has surged past 700 million ounces—driven by solar, electronics, and electrification. This year, mine supply is tracking around 825–830 million ounces, barely enough to meet industry needs with recycling included. That shortfall is showing up everywhere. EFP spreads between London and New York are flipping between contango and backwardation. Indian silver ETFs have absorbed nearly 100 million ounces in a few years. U.S. ETFs remain 30–35% below their 2021 peak of 1.1 to 1.2 billion ounces—even with spot above $50. When a market’s this tight, you don’t need panic buying—just no sellers.

The Brief:

- The U.S. labeling silver as a “critical mineral” gives policymakers new tools to subsidize mining, manage tariffs, and rebuild stockpiles—all of which tighten the physical market.

- China smelts roughly 40% of world silver and exported 136–145 million ounces recently, meaning even a modest export cutback of 15–20% would materially restrict global supply.

- Global mine production is still ~70 million ounces below its 2015 peak of 900 million ounces, while industrial demand has climbed above 700 million ounces, led by solar growth.

- Total mine supply around 825–830 million ounces leaves little room once you account for industrial use, investment demand, and recycling, forcing the market to draw from above-ground stocks.

- Backwardation in silver—something that historically should never happen in a well-supplied market—now appears regularly, signaling real tightness in London and the LBMA system.

- Indian silver ETFs, which barely existed three years ago, now hold close to 100 million ounces and can add 20 million ounces in a single month, occasionally hitting sourcing limits.

- U.S. ETF holdings are still 30–35% below their 2021 highs despite prices over 50 dollars, suggesting the problem isn’t a lack of demand—it’s a lack of available metal.

- Between deficits, export restrictions, ETF accumulation, and central bank interest, the conditions are in place for silver to potentially triple over the next five years—with volatility guaranteed along the way.

Charts Discussed

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]