Physical Gold and ETFs: Risk Mitigation

For any fiduciary, institutional, or individual investor considering precious metals, this article is a must-read. It outlines the real structural risks between owning physical metals held directly—either in your possession or stored in a secure, segregated vault—and owning exchange-traded funds (ETFs) through a brokerage account.

As manager of a physical gold and silver fund and owner of a large depository, I understand the critical nuances between price representation and actual ownership of precious metals.

Many investors use ETFs to gain price exposure to gold and silver. But that’s all it is—exposure. What you actually own is not metal, but a paper representation of its price at a given moment.

Gamestop, Robinhood & Systemic Risk

Let’s rewind to the Gamestop/Robinhood incident. That event exposed systemic vulnerabilities—namely, what happens when liquidity dries up and brokerages freeze trades to protect themselves. Watch this video below for a clearer picture of what a liquidity crisis looks like and how fast contagion can spread across clearing houses and brokerages.

Now imagine a similar situation—but in reverse. What if, in a crisis, institutions halt selling of precious metals ETFs to prevent a collapse?

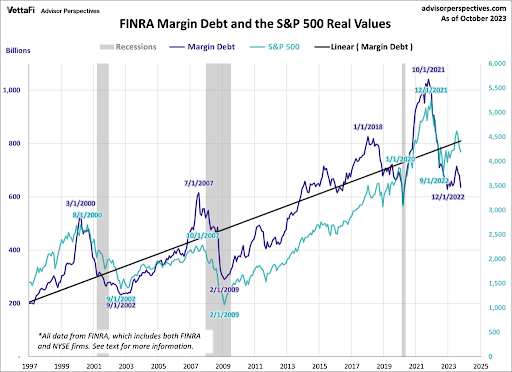

Margin Debt at All-Time Highs

According to FINRA, as of January 2020, margin debt rose 2.6% month-over-month to an all-time high.

High leverage creates fragility. In the next major correction, the web of counterparties and rehypothecation could snap.

Trying to diversify away from systemic risk using a traditional brokerage account is like the dinosaurs relying on biodiversity when the asteroid hit. Didn’t help them either.

Illusion of Ownership: The DTC and Cede & Co.

Most investors don’t realize that they’re not the registered owners of their ETF shares. The Depository Trust Company (DTC) holds legal title, with its nominee Cede & Co. listed as the registered owner—not you.

You are merely a “beneficial owner”—a technicality that strips you of direct control.

From the DTC website, SEC filings, and the GLD prospectus:

- “The Securities will be issued as fully-registered securities registered in the name of Cede & Co.”

- “DTC has no knowledge of the actual Beneficial Owners of the Securities.”

- “Global certificates are deposited with DTC…evidencing all of the Shares outstanding at any time.”

So, What’s the Point of a Precious Metals ETF?

It’s a price proxy. Nothing more. Like a boat—fun to own until it sinks. Then it’s your liability.

Precious metal ETFs are typically structured as indenture or grantor trusts. Most are not registered investment companies under the Investment Company Act of 1940.

The Safer Path: Direct Physical Ownership

The best way to hold precious metals is either:

- Within arm’s reach, or

- In a fully segregated, insured depository account

With physical metal, there is no Cede & Co. stamped on your bar. There are no intermediaries standing between you and your assets during a crisis.

Want more insight? Listen to this podcast interview.

Final Thoughts

Fiduciaries and individual investors need to understand this distinction:

- Paper price exposure ≠ Metal ownership

- Brokerage accounts ≠ Direct control

If the system buckles, you’ll want to be holding the real thing.

If you have questions or want to dig deeper, reach out. And please—share this article with anyone navigating the confusing world of gold and silver investing.

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]