Silver Shock: What’s Behind Collapsing Premiums and Rising Lease Rates

Retail is drowning in product—yet lease rates are screaming higher. The silver market is setting up for a move few will understand, and even fewer will trust.

What and why this is happening will stun many. I’ve been warning about cracks in the silver market for over a year—but what’s unfolding now goes far beyond collapsing premiums or investor fatigue. Beneath the surface, a very different kind of pressure is building. If you’re only watching retail, you’re missing the real setup for a supply shock in silver.

Retail shelves are overloaded. Premiums are down, dealers are tapped, and frustrated investors are selling into every bounce. On the surface, it looks like demand is drying up. But behind the curtain, miners are pulling back production and unwinding hedges after getting torched on price swings. That’s tightening supply for industrial bars—just as fabricators and refiners need metal the most.

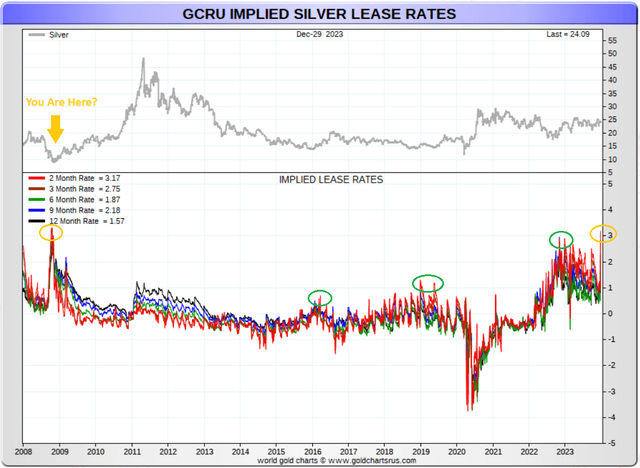

As a result, lease rates are rising, refinery throughput is shrinking, and structural cracks are starting to show. If silver rips higher from here, most retail investors won’t understand why—and they’ll likely miss the move. For a deeper dive into what’s really driving this shift, check out Paul Franke’s recent analysis—it adds serious weight to what I’m seeing unfold.

Silver Shock Summary:

- Retail Glut: The coin and bar market is saturated with product, and premiums have collapsed across the board.

- Dealer Stress: Buyback bids are falling, signaling liquidity stress and maxed-out balance sheets at many dealers.

- Mining Hedge Unwind: Miners closed hedges as silver rallied—only to get whipsawed by a drop back to $23, forcing production cutbacks.

- Supply Withdrawal: Mining companies are delaying deliveries and canceling forward contracts, reducing refinery throughput.

- Industrial Tightness: Larger 1,000 oz bars and industrial-grade silver are getting harder to source—despite weak retail demand.

- Lease Rate Spike: Lease rates are climbing, not because of ETF or retail demand, but due to real-world fabrication and industrial need.

- Investor Sentiment: ETF outflows and retail liquidation suggest investors are checked out—setting the stage for a misunderstood price breakout.

- Supply Shock Setup: A sharp move higher could be driven by structural constraints and contract unwinds—catching most off guard.

Charts Discussed

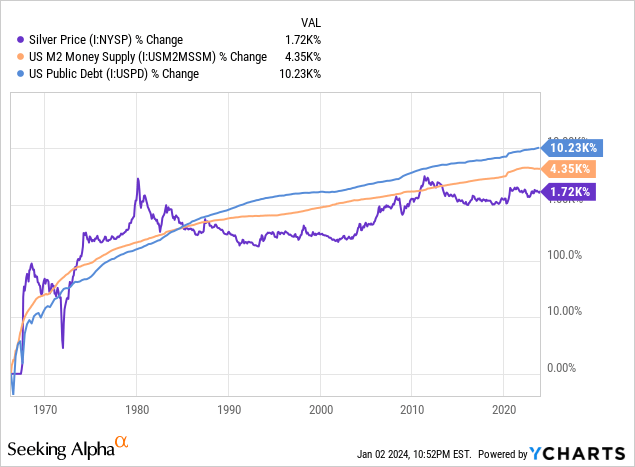

YCharts – Silver Price vs. M2 & Treasury Debt Growth, Since 1965

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]