Basel III and Gold: How Banks Are Navigating the 85% RSF Requirement

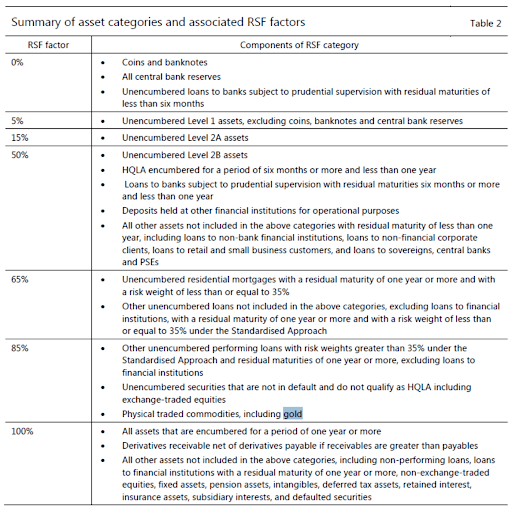

There’s been no shortage of noise about how Basel III would “remonetize” gold or rewire the financial system. But buried beneath the hype is a more technical—but far more important—story: how banks are sidestepping the 85% Required Stable Funding (RSF) ratio for gold under Basel III.

Let’s dig into what’s really happening—and what it means for gold investors.

The Story Behind the Exemption

In 2021, the UK’s Prudential Regulation Authority (PRA)—which oversees British banks—quietly announced a major shift in its treatment of precious metal holdings.

“Following a consultation, the Bank of England’s Prudential Regulatory Authority (PRA) said on Friday it had ‘decided to amend its approach to precious metal holdings related to deposit-taking and clearing activities.’”

This is key. Clearing and deposit-taking are being treated differently. And that separation matters.

What Changed with Clearing Activities?

Here’s what the PRA published (verbatim):

“The PRA has considered the responses and decided to amend its approach to derivative client clearing. The PRA will exempt from the NSFR derivative client clearing activities with qualifying CCPs (QCCPs), provided that the institution does not provide to its clients guarantees of the performance of the QCCP and, as a result, does not incur any funding risk.”

This helps explain why we saw precious metals trading activity migrate in 2020 toward central counterparties (CCPs)—such as the CME (which owns COMEX and operates CME Clearing House). These platforms allowed banks to:

- Transfer trading risk off their balance sheets

- Avoid reserve requirements

- Keep customers trading “through” the bank—not “with” it

The only capital the bank has to hold? The margin that exceeds the required minimum.

What About Deposit-Taking Activities?

The PRA also introduced a new concept: interdependent precious metals permission.

From the policy statement:

“The PRA has introduced an interdependent precious metals permission for which firms may apply in respect of their own unencumbered physical precious metal stock and customer precious metal deposit accounts. When the permission is granted, firms would apply a 0% RSF factor to their unencumbered physical stock of precious metals, to the extent that it balances against customer deposits.”

This essentially allows a 0% RSF when a bank matches unencumbered gold to customer liabilities—but only under specific legal and accounting conditions.

Is it referring to allocated or unallocated gold? That part is unclear. In an allocated setting, the customer owns specific metal, and the bank simply acts as custodian (no balance sheet liability). In unallocated structures, the bank owes the customer metal—a liability.

The Legal Basis: Interdependent Assets and Liabilities

Thankfully, there’s clarification under EU Article 428f, which defines “interdependent” assets and liabilities. Full Article Text

Some of the key requirements:

- The institution acts only as a pass-through

- The asset and liability are equal in amount and maturity

- The asset’s payment flows are used only to repay the liability

- The institution bears no funding risk

“Assets and liabilities shall be considered to meet the conditions […] where they are directly linked to […] derivative client clearing activities, provided that the institution does not provide to its clients guarantees of the performance of the CCP […]”

This is the legal foundation behind the 0% RSF treatment: when banks fully match unencumbered gold with their liabilities, the capital requirement vanishes.

How the LBMA Got Its Win

The London Bullion Market Association (LBMA) had lobbied hard for this exemption.

“This is one of the key points that we’ve been asking for all these years,” said Sakhila Mirza, LBMA’s chief counsel. “Clearing will be exempt.”

The move transferred risk off bank books and into centrally cleared exchanges. While banks lost some proprietary trading profit, they gained something more valuable: massive regulatory relief.

Why Gold Still Isn’t a High-Quality Liquid Asset (HQLA)

“The PRA said it would not classify gold as a high-quality liquid asset (HQLA), which would have freed other trades such as precious metals loans and leases from the high capital requirement.”

The PRA’s decision aligns with the Basel Committee’s treatment of gold, which found that it failed HQLA status based on one factor: volatility.

But that assessment has drawn criticism.

Gold’s “Volatility” Problem

One of the primary studies cited was by Batten and Lucey (1999–2005), which modeled gold’s volatility through futures markets—heavily influenced by leverage and short-term speculation.

As Bob notes:

“Using a leveraged futures market to measure a physical asset without counterparty risk is like measuring the movement of a feather in a wind tunnel.”

Other research by Baur and Lucey shows gold reacts asymmetrically to shocks, with positive price moves increasing volatility more than declines—a trait linked to its safe haven role.

The irony? This volatility might be a sign of strength during a crisis, not instability. But the Basel framework penalizes it anyway.

So What’s the Bottom Line?

Basel III is voluntary and implemented differently in each jurisdiction.

In the UK, banks now have a clear path to:

- Reduce RSF requirements on gold from 85% to 0%

- Continue offering unallocated gold accounts

- Keep trading via central clearing with minimal capital exposure

The net result?

- Banks win with lower funding costs

- The physical gold market gains influence as unallocated leverage winds down

- But derivatives exchanges still dominate volumes—for now

If open interest continues to decline and physical demand stays strong, influence may shift toward the real market.

But as always, we ask:

Is this true reform—or just another case of “the more things change, the more they stay the same”?

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]