Preparing for Silver’s Short Squeeze: In-Depth with Bob Coleman & Dave Morgan

Jim Puplava and I sat down with Dave Morgan (The Morgan Report) for a deep dive into silver’s explosive rally. We explored what structural deficits and shifting sentiment could mean for your portfolio.

In this roundtable on Financial Sense Newshour, I reconnected with Dave Morgan to analyze silver’s rally and future trajectory. We broke down the structural supply deficits tightening the market. Shifting investor psychology is adding serious momentum.

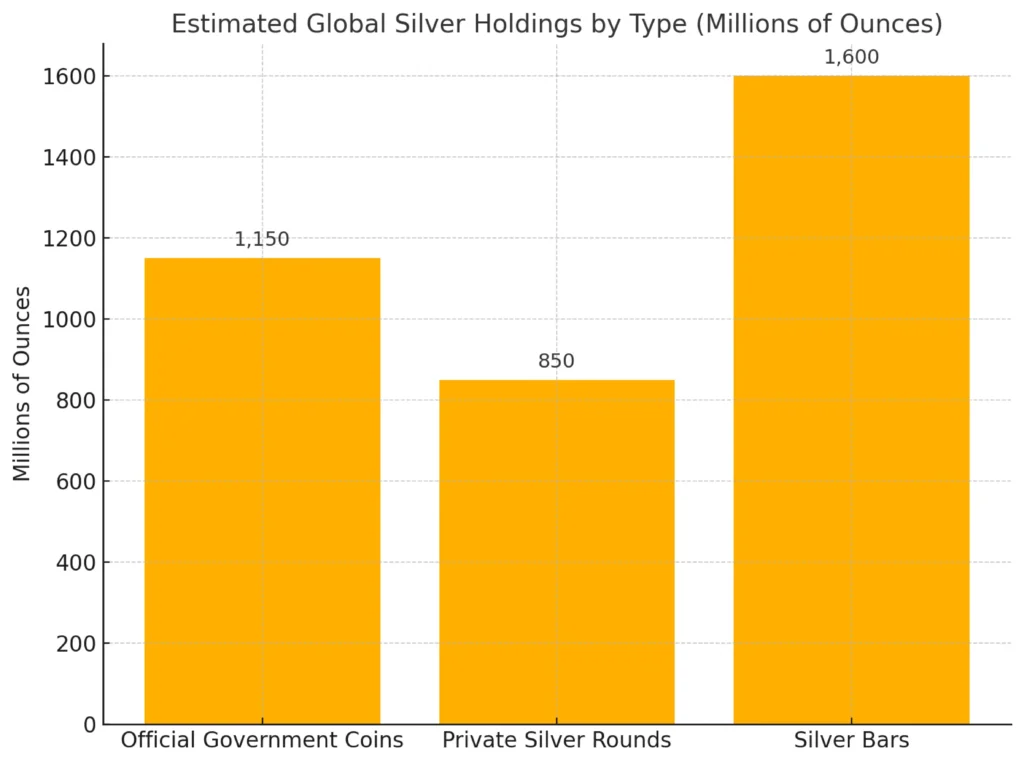

We didn’t hold back. We discussed ETF mechanics, industrial demand, and rapidly depleting above-ground stockpiles affecting silver prices.

Our trio also covered the contrasting risks and opportunities in physical silver versus mining stocks. These are two very different plays.

Whether you’re a retail investor staying ahead or an institution watching macro shifts, this talk is packed with insights. If you want to understand what could push silver higher—and what might trigger it—don’t miss this.

Silver’s Rally Summarized:

- Silver’s Breakout: Silver is up 35% year-to-date and 64% since early 2024—its highest level since 2011. Momentum is in our favor.

- ETF Squeeze & Liquidity Crunch: SLV and other ETFs saw short squeezes and new share creation, tightening liquidity and spiking lease rates.

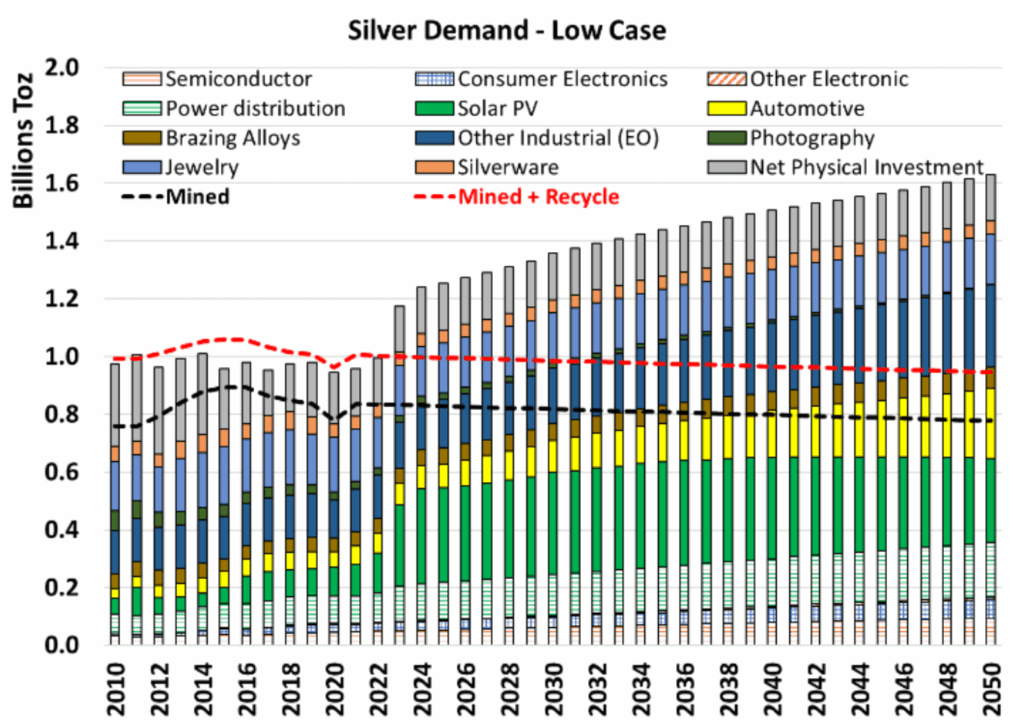

- Persistent Supply Deficit: This marks silver’s fifth straight year of structural deficit. Above-ground stockpiles are vanishing fast—and that matters.

- Industrial Demand Is Surging:Silver demand is 60–70% industrial—led by solar, EVs, and tech. That usage trend is growing, not slowing.

- Retail vs. Institutional Flow:Retail is selling into strength. Meanwhile, institutions are quietly increasing exposure via ETFs and direct physical allocations.

- Mining Stocks Gaining Leverage: Rising prices are creating real leverage. Marginal producers and top-tier miners are finally seeing strong profit growth.

- Gold/Silver Ratio Compression: The gold/silver ratio is still historically high. If it reverts, silver has major upside potential ahead.

- Macro Tailwinds: Geopolitical risk, monetary panic potential, and global central bank buying are fueling long-term bullish sentiment in silver.

Charts Discussed

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]