Silver’s Breakout Moment: Why the Smart Money Is Shifting Hard Into Metals

Between trapped shorts, industrial expansion, and collapsing trust in debt markets, silver is finally acting like the strategic asset it was meant to be. Here’s why I’m 74% allocated to it.

I recently sat down with Steve Yang of Natural Resource Stocks to talk about what’s really driving the metals markets—beyond the headlines and hype. From physical demand in Asia to structural shifts in silver, this was one of the most in-depth interviews I’ve done in a long time.

We started with gold. Asian demand—especially from India and China—has been relentless, with Diwali season lighting up the physical market. At the same time, central banks are stacking gold as a neutral reserve asset, hedging against currency debasement and political fallout. But here’s the real story: investors are quietly stepping away from debt markets and moving into tangible stores of value.

Then we got into silver—and this is where things got interesting. In October, we saw a full-blown gamma squeeze, surging industrial demand from solar and battery tech, and record short activity in SLV. Silver is now acting like a strategic asset, not a sidelined metal. I explain why I’ve allocated 74% of my fund to silver and what that positioning says about what’s coming. If you want to understand the setup, the risk, and the opportunity—it’s all in this interview.

The Brief:

- Asian festival season (like Diwali) drove record physical gold demand, especially in October, reinforcing Asia’s preference for physical over ETFs.

- Shorts were trapped in a derivative-driven gamma squeeze, leading to extreme volatility and a surge in silver prices in mid-October.

- Solid-state silver battery tech could cut charge times in half and double EV range, pointing to explosive future industrial demand.

- Silver’s role is hybrid—both monetary and industrial—and now 75% of silver demand is industrial, led by solar, electronics, and medical uses.

- The gold-to-silver ratio peaking at 80:1 suggests silver is undervalued, and institutional flows are starting to rotate accordingly.

- The idea of long-term price suppression is exaggerated—most “manipulation” claims ignore how modern derivatives and market mechanics work.

- Physical metal should be held directly when possible—not through dealer-controlled programs that expose investors to unnecessary counterparty risk.

- Premiums and spreads matter—buying hyped products at inflated markups (e.g. Silver Eagles during supply crunches) can destroy portfolio returns.

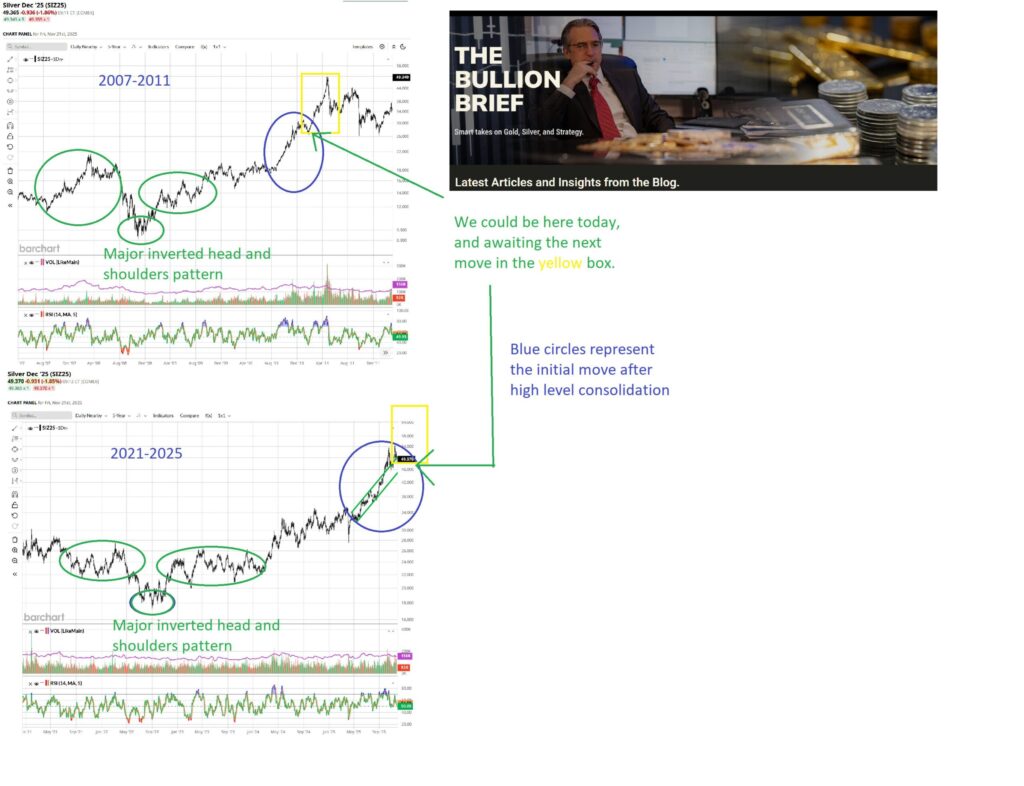

Charts Discussed

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]