The Silent Killers of Silver: Structural Manipulation No One Talks About

Silver price manipulation runs deeper than order stacking or short-selling—it’s baked into the system through derivatives and futures. Institutions quietly steer prices using paper contracts, while retail investors are left reacting to moves they never saw coming.

It’s not just spoofing or naked shorts—it’s deeper, systemic, and hidden in plain sight.

Most investors think they understand manipulation. They’ve read about spoofing scandals or naked short selling. But the kind of manipulation I discussed in this interview is quieter—more institutionalized—and far more dangerous to retail participants. This isn’t tinfoil hat territory. It’s documented. It’s strategic. And if you care about your exposure to physical silver, you need to look under the hood of the global derivatives machine.

In this interview, I pulled back the curtain on what I call “structural manipulation.” These are the tools big players like JPMorgan use—not in some backroom conspiracy, but through regulatory-approved mechanisms like derivatives, options, and warehouse movements. When you understand how these levers move the market, you’ll realize that the silver price you’re watching isn’t always reflecting supply and demand—but a reflection of how the game is rigged against you.

The Brief:

- Price manipulation goes beyond spoofing: Structural tools like derivatives, not just naked shorts, drive silver prices.

- Big banks influence price silently: Institutions use paper contracts to overwhelm true supply/demand dynamics.

- Retail is the last to know: By the time price moves happen, the setup has already occurred behind the scenes.

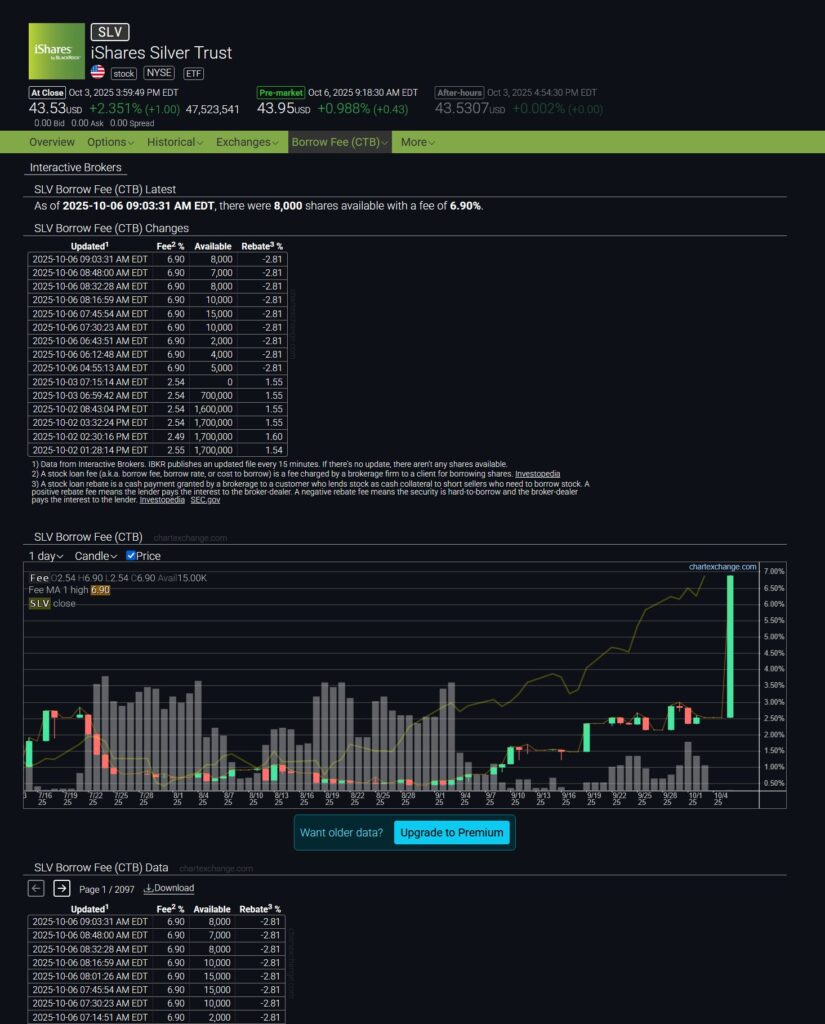

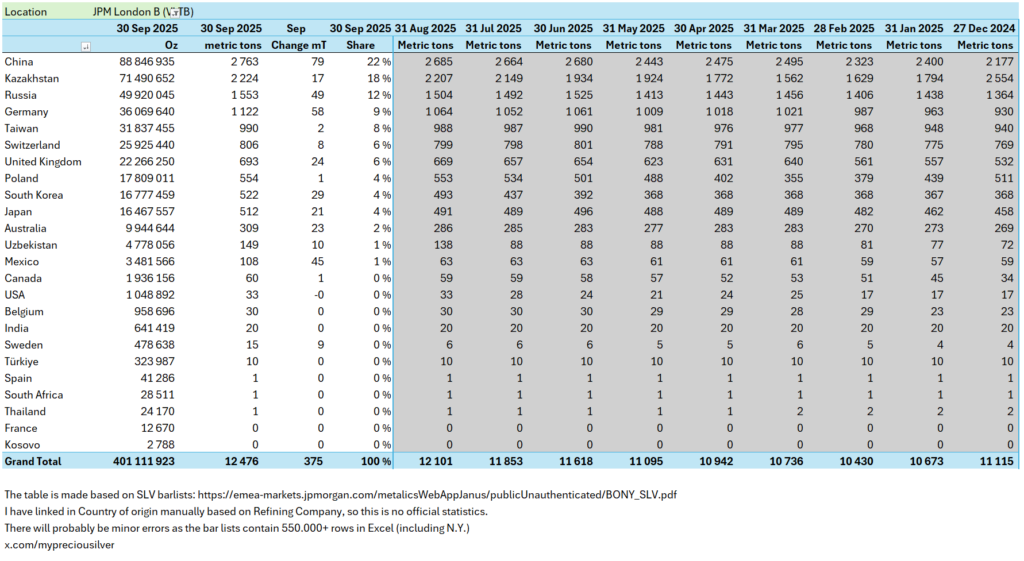

- Warehouse stocks are a signal: Pay attention to metal leaving London or COMEX—it hints at stress or demand off the radar.

- Futures contracts can suppress spot prices: Institutions stack these contracts to keep physical prices from breaking out.

- Watch open interest levels: Rising or falling open interest can reveal large players repositioning.

- Regulators have failed to act: Despite clear documentation, systemic manipulation is often ignored or lightly punished.

- Physical metal is your insurance: Unlike ETFs or digital exposure, physical silver is outside the games played in paper markets.

Charts Discussed

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]