Why Gold & Silver EFP Premiums Are Blowing Out Again — Here’s What It Means

EFP premiums for gold and silver have spiked dramatically amid tariff fears and supply stress. I break down what’s driving the NY‑London gap—and what it means for your bottom line.

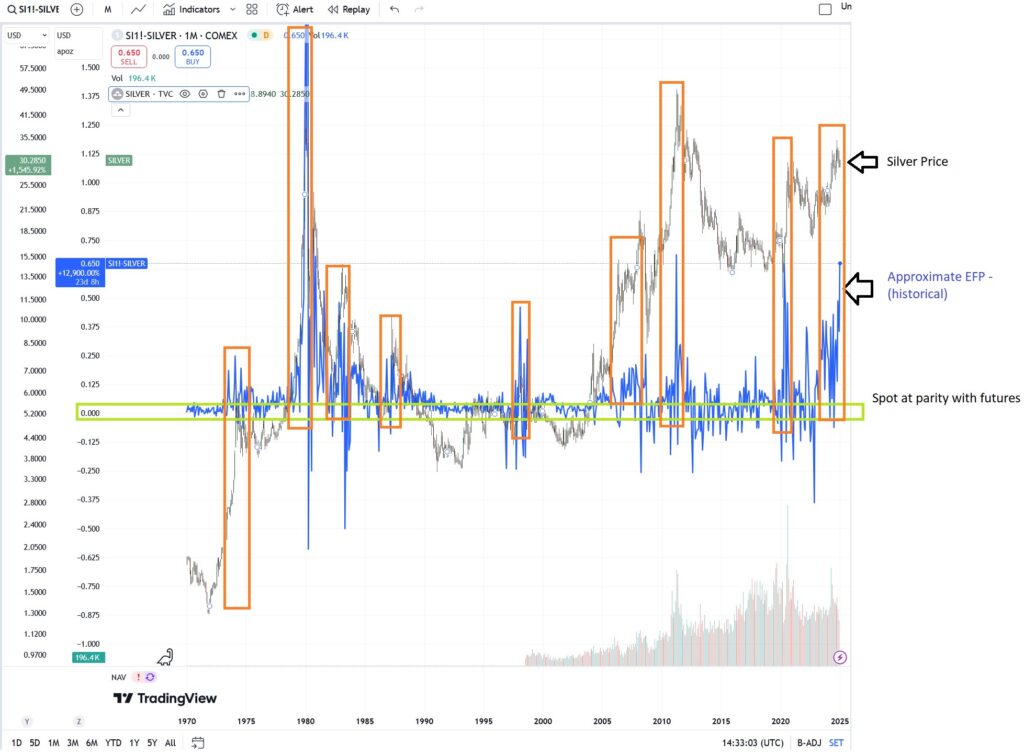

I sat down with Chris Marcus from Arcadia Economics to talk about a warning sign most investors are missing—the blowout in gold and silver EFP premiums. When you see spreads between COMEX futures and London spot jump this hard, it’s not a fluke—it’s structural. Gold’s EFP pushed past $60, silver over $1, and that kind of dislocation tells me something’s breaking beneath the surface. We’ve seen this before—March 2020 comes to mind—but this time, it’s being driven by tariff fears, delivery risk, and a rush to secure physical metal.

In this interview, I break down why banks are panicking, why retail premiums are climbing, and what this disconnect means for the broader market.If you own metals or you’re sitting in paper, you’ll want to hear this.

The Brief:

- Gold EFP spread: Blew out over $60—huge divergence between COMEX futures and London spot.

- Silver EFP spread: Jumped more than $1 per ounce—major delivery stress unfolding.

- Historical comparison: Closest we’ve seen to this was March 2020 during the COVID refinery/logistics meltdown.

- Tariff pressure: Traders are front-running possible U.S. bullion import tariffs—especially out of China.

- Bank exposure: Institutions short EFPs are getting crushed and scrambling to hedge, widening the spread.

- Retail premiums: Expect higher costs on coins, bars, and physical product as this bleeds through.

- Systemic warning: A blown-out EFP spread means futures and physical markets are falling out of sync.

- Global demand: Central banks and industrial users are quietly stacking while ETFs hemorrhage ounces.

Charts Discussed:

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]