Why Gold and Silver Prices Aren’t Soaring—Despite Massive Outflows

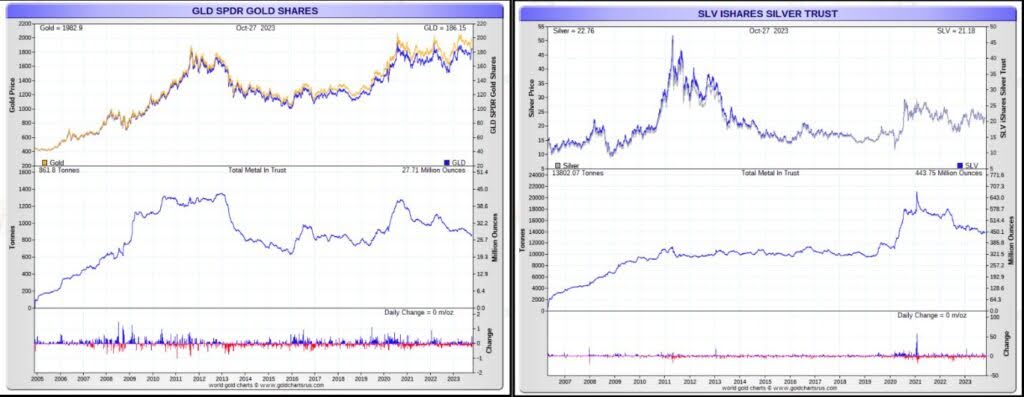

This disparity has persisted for decades:

Why is there a significant outflow of ounces from SLV and GLD—yet the price barely moves?

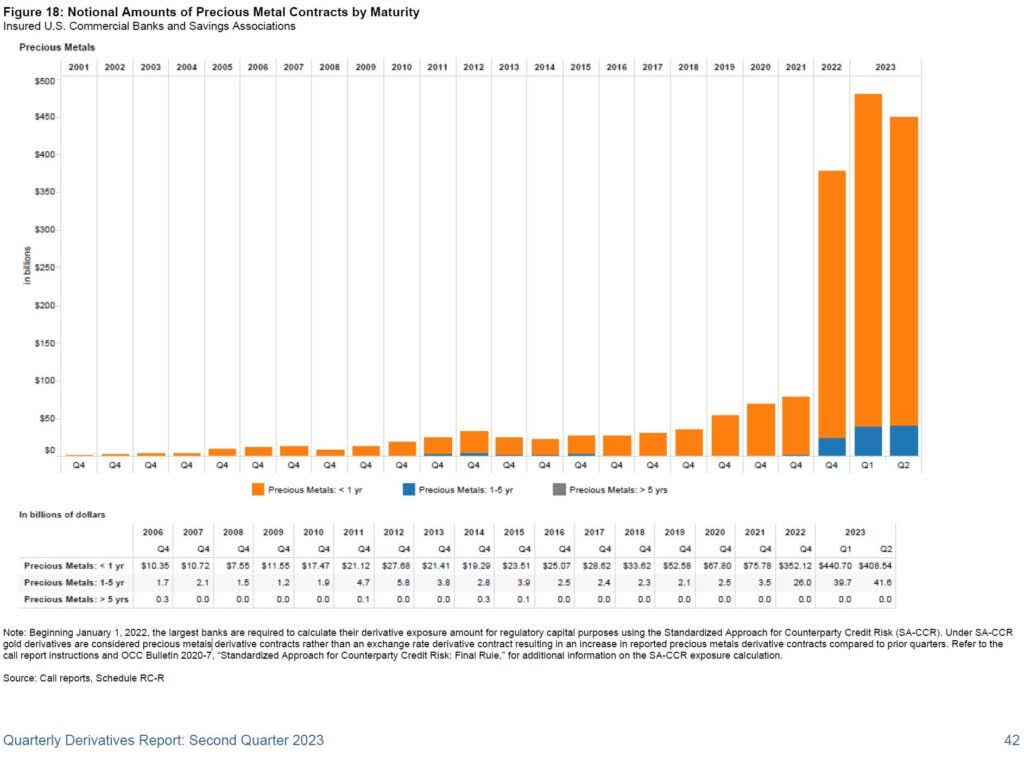

And while physical ounces leave the vaults, derivatives on precious metals have exploded in recent years, according to OCC data:

To borrow a line from Bob Dylan:

“The answer, my friend, is blowin’ in the wind.”

This isn’t about COMEX games or vault shell companies. This article focuses on a far more opaque investment framework—one that’s siphoning trillions of dollars away from physical metals and into derivative-laced funds.

The BlackRock Warning You Shouldn’t Ignore

In a recent headline, BlackRock warned:

“Investor disdain for mining threatens green transition.”

Translation? The world’s largest asset manager is finally acknowledging a core truth: massive capital flows are not going to real assets.

To understand why, you have to peel back the regulatory incentives that disincentivize physical ownership of metals like gold and silver.

The 12-Trillion Euro Diversion Engine: UCITS

This all began in the 1980s in Europe, with the introduction of a regulatory framework called UCITS (Undertakings for Collective Investment in Transferable Securities).

While UCITS funds can offer exposure to commodities, they cannot own them directly. Instead, they use derivatives to simulate exposure. This is the core flaw—and the quiet genius—of the system.

UCITS can include:

- Over-the-counter (OTC) and exchange-traded derivatives

- Total return swaps

- Credit default swaps (CDS)

- Commodities indices and futures contracts

They can’t take delivery of physical gold or silver. Even if they wanted to. Even if the fund holds the real asset.

Real Metal, but No Redemption Rights

Take PSLV (Sprott Physical Silver Trust). It holds actual silver. But if you’re a UCITS-compliant investor? You can’t redeem your units for metal—only cash.

And even that cash redemption comes with a haircut. In some cases, investors may only get 95% of the lesser of:

- The volume-weighted average trading price over the last five days

- Or the NAV at the end of the month

Hardly a fair deal for someone seeking true asset exposure.

Popular UCITS Funds That Don’t Actually Deliver Metal

There are many UCITS-compliant ETFs that market themselves as “physical” exposure:

- WisdomTree Enhanced Commodity UCITS ETF

- iShares Physical Gold ETC

- SPDR Gold Shares (GLD)

But these products are still governed by derivative wrappers, not delivery mechanisms. And it’s not just European money. U.S. fund companies have built entire product lines to tap into the UCITS capital pool.

👉 Over €12.4 trillion sits in UCITS assets.

👉 More than €5 trillion is in equity ETFs alone.

That’s trillions of dollars not going to real metal.

Derivatives: The Great Commodities Detour

Big asset managers have created structured products to divert massive monetary expansion into synthetic commodity exposure—rather than letting it push up the prices of actual commodities.

By cloaking gold and silver in layers of derivatives, they’ve:

- Muted true price discovery

- Reduced demand for mining and production

- Shifted volatility to the paper side

Introduced risks like leverage, counterparty failure, and systemic contagion

Basel III, Paper Assets, and the Illusion of Safety

Basel III was supposed to reduce leverage and system-wide risk. But here’s the rub:

In a world drowning in debt and geopolitical uncertainty, real assets—directly held and unleveraged—are more important than ever. But that model doesn’t make Wall Street money.

So instead, we get paper. Layered. Abstracted. Derivative-laced.

When the Mirage Dissolves

Most pension funds, institutions, and retail investors are banking on exposure to gold and silver through these passive strategies.

But in a real crisis—or during a major risk-off event—they may find they own nothing but a mirage.

Commodity prices will always be volatile. But owning real, physical gold and silver removes many of the deeper risks that synthetic instruments simply weren’t designed to address.

Read the Fine Print. Know Your Counterparty

Before you go passive with your metals strategy:

- Read the user agreements

- Study the prospectuses

- Compare the risks of derivative-based exposure vs. actual ownership

Ask yourself the most important question:

Do you even know who your counterparty is?

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]