The Silent Mechanism Behind Silver ETFs (And Why It Might Be Weaponized)

One popular tool for silver exposure is the ETF—Exchange Traded Funds. But before you park your trust (and capital) there, let’s look behind the curtain. This isn’t about price charts or performance—it’s about structure, and the ending may surprise you.

How ETFs Actually Work (And Who’s Pulling the Levers)

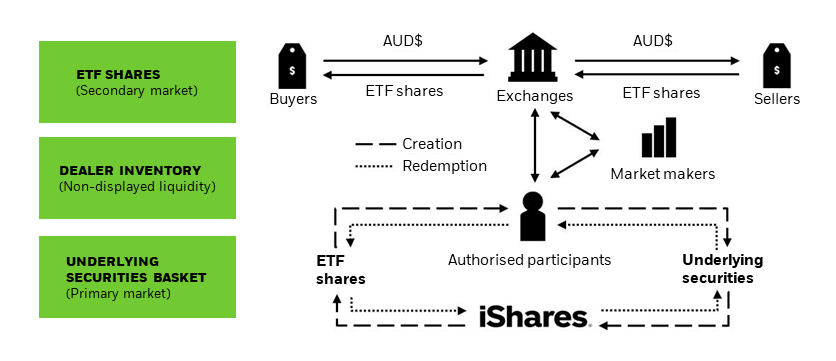

Market makers and Authorized Participants (APs) are the middlemen behind the ETF curtain. Their job? Keep the ETF’s share price aligned with the actual value of the underlying metal—silver, in this case.

They do this by:

- Creating or redeeming shares based on investor flows

- Arbitraging price gaps between the ETF and its Net Asset Value (NAV)

Here’s a quick look at how this works:

Naked Shorts & Temporary Plays—Until They Aren’t

Market makers have the ability to go short, even naked short, to maintain an orderly market. When buyers overwhelm the system and push price upward due to lack of sellers, market makers can sell shares they don’t own to meet that demand.

These aren’t supposed to be directional bets—they’re short-term “band-aids” to keep the machine running. But when unexpected volume or geopolitical events hit, those “temporary” positions can become explosive.

This Isn’t GameStop—This Is Bigger

Unlike meme stocks, ETFs like SLV allow APs to create new shares by delivering physical silver to the fund. This means they can reduce short pressure by backing up their positions with metal—if they want to.

But what happens when they don’t?

ETFs as Financial Sponges—Not Physical Demand Drivers

This is where it gets serious.

When investor demand spikes, APs and market makers can meet that interest by shorting shares instead of delivering silver. Why does that matter?

Because if they had to deliver real metal, it would:

- Increase physical demand

- Tighten the silver supply

- Drive up prices

But by soaking up capital flows with paper shorts instead, they keep pressure off the underlying silver market.

Translation: the ETF can act as a sponge, diverting demand away from physical silver.

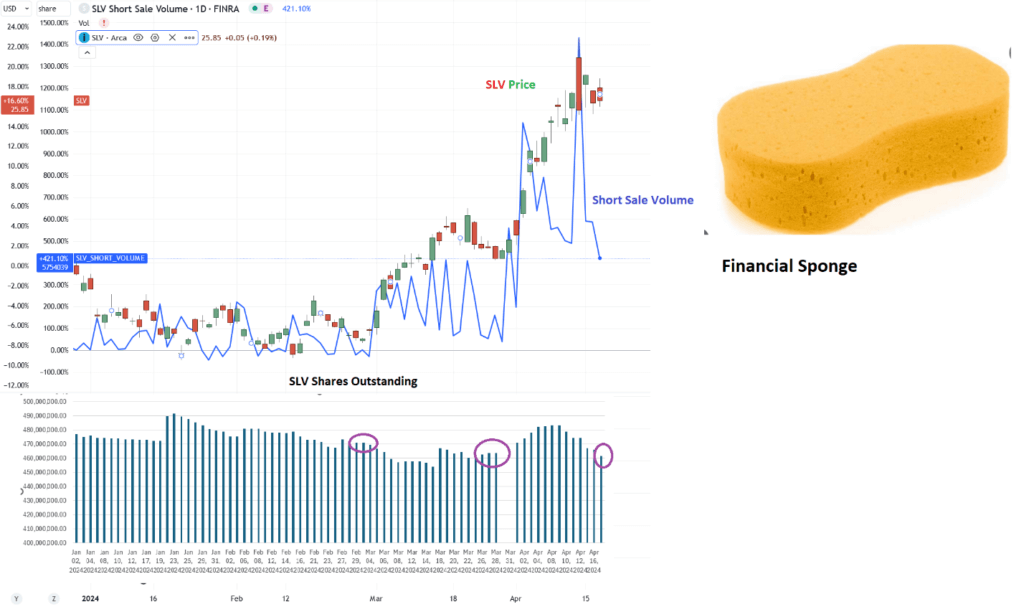

The SLV Chart: What It’s Really Telling Us

Take a look at this chart from SLV, the largest silver ETF:

While the price surged upward, shares were redeemed (purple circles). Meanwhile, short volume spiked.

So… who’s selling into a rally?

Are investors dumping silver at the breakout?

Are contrarians shorting every move higher?

Or—most concerning—are market makers filling buy orders with short sales, rather than backing the ETF with fresh physical silver?

But What About China?We’ve been told China is the mystery buyer fueling the precious metals rally. That may be true.

But if physical silver is so tight, why hasn’t the EFP (Exchange for Physical) spread collapsed or gone backward?

In the past month, the EFP has stayed strong—suggesting most of the demand is still happening in futures and paper, not the physical market. And that raises a deeper question…

The Real Shock: Is Someone Front-Running China?

Here’s the mind-bender:

What if another major entity—or even a government—is front-running Chinese demand, forcing them to pay inflated prices for gold and silver?

Think about it:

- U.S. ETFs aren’t seeing big metal deliveries

- Paper shorts are absorbing capital inflows

- Physical is going elsewhere—at a markup

Why? Simple.

By draining China’s liquidity into overpriced gold and silver, you weaken their broader economy. That curbs their commodity buying (like copper), which helps suppress global inflation—especially here in the U.S.

And in an election year? It’s every country for itself.

Final Thought

ETFs may be “easy,” but don’t mistake them for neutral. The structure behind the scenes may not just be passive finance—it might be economic strategy.

Meet the Author

Bob Coleman, with a successful career in investment and portfolio management since 1992, is the founder of Idaho Armored Vaults and Profits Plus Capital Management, dedicated to providing secure and comprehensive solutions for precious metal investment and storage, emphasizing transparency, risk mitigation, and client-focused service.

BOB COLEMAN

President

(208) 468-3600

[email protected]